Ivalua zum Leader ernannt 2025 Gartner® Magic Quadrant™ for Source-to-Pay Suites

Bericht lesen

Ivalua zum Leader ernannt 2025 Gartner® Magic Quadrant™ for Source-to-Pay Suites

Bericht lesen

Blog »

by Alex Saric

Part I: Bridging the Gap between Procurement and Finance. A New Vision for Amrest

Amrest, a restaurant operations leader in Europe, was looking to create one business, one team, with one mission. To achieve their long-term goals, they needed to bridge the gap between their procurement and finance teams.

Where to begin? Let’s start with their business model and current challenges.

Amrest runs more than 2300 locations, including KFC, Pizza Hut, Burger King and Starbucks franchises, along with its own brands of restaurants. They are a leader in 25 countries, with over 30 million customers every month, over 45,000 employees, and almost 2 billion in sales last in 2021.

Franchisee, Franchisor, Owner

Amrest operations include multiple complex business models with a long history and high potential. Due to its many complexities and its strong reliance on financial support, it is not an easy business to merge franchisee/franchisor operations into their own brands. For example, if an individual would like to open a Pizza Hut in France, they would become a franchisee of Amrest. They are also a franchisee of Starbucks in a few markets. Finally, Amrest owns its own brand of restaurants (like Blue Frog). All together, Amrest opened almost 150 new locations last year.

Amrest + Ivalua

Amrest has been using Ivalua ‘the tool’ since 2011 across nine countries, with almost 3000 end-users on the platform. Their KFC brand uses Ivalua daily, placing nearly 280,000 orders and processing 260,000 invoices annually. Currently, they’re seeing exceptional success in the purchase requisition, purchase order, and invoicing. They’re also ramping up usage in contract management.

There are interesting challenges within the AmRest business model at the supply chain level. The gap between procurement and finance is also a factor to consider that creates additional complexity. In addition, their multiple brands, operations and locations create layers of variable changes within their procurement processes and overall strategy.

As Amrest continues to audit their systems, they are gaining greater understanding of the disparate processes and leveraging Ivalua’s solutions along the way. To address their gaps, Amrest is building an end-to-end procurement process that covers all of their businesses and each unique challenge these operations face. These complexities are compounded by their multiple brands, markets, business models, and the different types of suppliers across varied requirements, laws, regulations, tax rates, and tax calculation methods.

One Tool, Many Challenges

One of the most important aspects of a business‘ success is making the right purchasing decisions. Amrest needed a tool that provided global visibility into all of their brands in order to streamline their purchasing decisions. In the perfect world, they could simply “lift and shift” processes across brands and countries to create one solution. Unfortunately, they could not fix a problem for KFC in Poland and then lift it up and move it into Bulgaria. The solution? Create a strategic payment circle to accommodate multiple operations and locations.

Strategic Payments: A New Way Forward

Amrest’s strategy for solving challenges was to break them down into bite-sized pieces, identify what is not working, review user requirements, and potential outcomes.

Their main priority focused on controlling spending across the whole Source-to-Pay journey. Amrest sought a reliable data source to provide a market comparison between countries as well as a breakdown of the primary factors that influence payments and the outcome of the payments. Introducing new solutions across multiple brands would also require updated sub-processes and workflows.

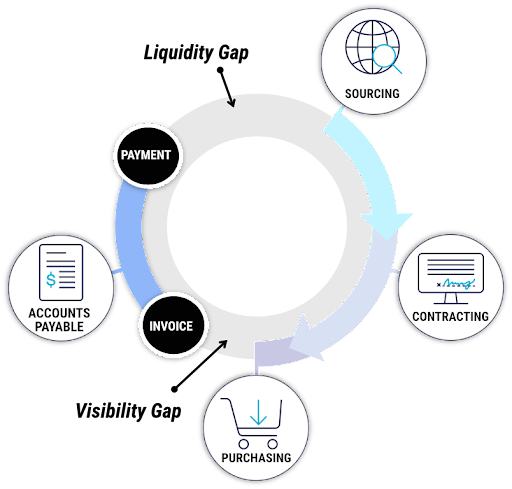

One View to Connect Procurement and Finance: Addressing the Visibility Gap and the Liquidity Gap.

For Amrest, it’s all about managing costs with budget and spend control acting as a key aspect of decision-making processes. From an organizational standpoint, their visibility gap could be addressed by joining systems across multiple countries, to create one view of the process for local procurement and finance teams. This single, consolidated view of data effectively bridges the liquidity gap to provide high-value data.

Armed with better metrics and data, Amrest was able to forecast and create accurate data models to support their strategic decision making process.

The Right Process + The Right Systems = The whole strategic payment journey becomes a closed loop.

What’s the recipe for Amrest’s payment success? Collaboration! If only one part of the business is involved, it will become the perfect process for that team, but not the perfect circle. They needed all parts of their organization to shift their own goals and create one, unified objective to build a better, more efficient payments model.

How can Amrest close the loop? They needed to remove some internal barriers to create one mission.

Most organizations create an artificial barrier between procurement and finance driven by siloed goals. If these objectives are not combined or coordinated, there will always be pushback from both teams. This division creates a split in priorities and responsibilities, creating new barriers and visibility gaps. Although finance is not a customer of the strategic payment process, they’re certainly a strategic partner and a key beneficiary.

To solve these problems, Amrest developed a procurement journey where suppliers could have a dual role, supporting company growth and bridging the gap between finance and procurement.

Stay tuned for our part II where we discover how Amrest is working as one company, with a unified vision to create a successful strategic payments process. As showcased in Amrest’s story, the Way You Pay Matters! Turn your Account Payables team into a strategic payments function!

Watch our on-demand video to see your own AP potential in action!

Author

Spanning a 30-year career, Stephen has led successful global product marketing launches alongside procurement experts and finance professionals in both the public and private sector. As a longstanding contributor in the ever-evolving sourcing industry—from early OCR—to the establishment of eInvoicing Networks, Stephen now applies his extensive tech experience to Ivalua’s unified Procurement platform. A problem solver and industry thought leader, his product positioning is central to generating long-term customer value while streamlining user experience. In software development, adaptability is the key and Steve’s commitment to the future of procurement is propelling Ivalua toward the next generation of strategic payment solutions. Outside of his professional life, Steve is a published author and 17th Century historian.